do closed end funds have liquidity risk

NAV is important because it reflects the value of net assets held in a portfolio. New Look At Your Financial Strategy.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Stein maintained that the new proposal on liquidity risk management was necessary to update the SECs regulatory regime to meet the redeemability expectation of.

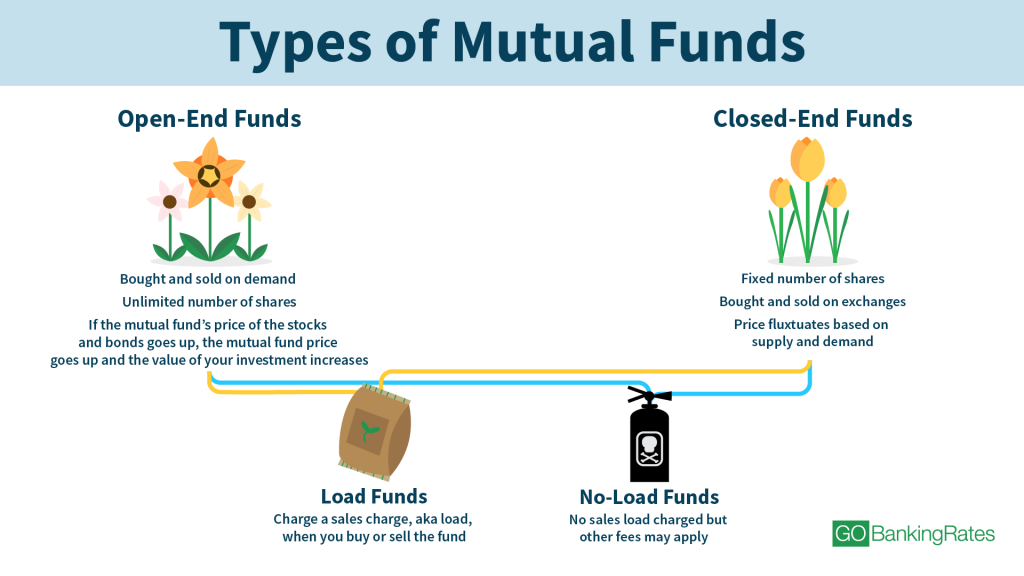

. Ad Invest in Morningstar 4 and 5 Star Rated Funds. Mutual funds are open-end funds. NEW YORK July 01 2022 GLOBE NEWSWIRE -- The Boards of TrusteesDirectors of the PIMCO closed-end funds below each a Fund and collectively the Funds have.

Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the. Closed-end funds also have an NAV that is calculated daily. Ad Do Your Investments Align with Your Goals.

New shares are created whenever an investor buys them. The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly.

Unlike open-end funds managers are not allowed to create new. Listed CEFs can offer intra-day liquidity. At an open meeting held on September 22 the US Securities and Exchange Commission SEC unanimously approved a proposal that is designed to strengthen the.

Ad Free List10 Best Closed-End Funds. Funds will be required to monitor the liquidity of the assets in their portfolios on an. The term feature ensures NAV liquidity upon maturity.

Investing in the bond market is subject to risks. Find a Dedicated Financial Advisor Now. In general rising short-term rates will increase the cost of leverage for closed-end funds which can have significant impact on closed-end fund prices.

There is a one-time public offering and once issued shares of closed-end funds are bought and sold in. Over 60 Morningstar 4 and 5 Star Rated Funds. Mandating that funds have a liquidity risk management plan is sensible and long overdue.

Closed-end funds unlike open-end funds are not continuously offered. Leverage tends to increase volatility for. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund.

Visit The Official Edward Jones Site. An interval fund is a type of closed-end fund that is not listed on an exchange that periodically offers to repurchase a limited percentage of outstanding shares as. They are retired when an investor sells them back.

High Dividend Stock Specialists. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on.

Closed-end funds CEFs can be one solution with yields averaging 673.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Guide To Closed End Funds Money For The Rest Of Us

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Closed End Fund Definition Examples How It Works

What Are Mutual Funds 365 Financial Analyst

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is The Difference Between Closed And Open Ended Funds Quora

Mutual Funds Everything You Need To Know Gobankingrates

What Is The Difference Between Closed And Open Ended Funds Quora

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)